The Moving Average Convergence Divergence (MACD) is one of the most popular technical indicators used to generate signals among stock traders. This indicator serves as a momentum indicator that can help signal shifts in market momentum and help signal potential breakouts. Integrating this signal into your algorithmic trading strategy is easy with Python, Pandas, and some helpful visualization tools.

Moving averages are excellent indicators of overall market trends. They can help signal intraday trends, resistance or support levels, or even signal the end of a bull market. The MACD takes moving averages a step farther and provides insight into the buying and selling pressure in a market. That’s to say; the MACD can help signal when a market has become overbought (time to sell) or oversold (time to buy).

MACD 101: Understanding the Indicator

Before we get into calculating and applying the MACD using Python we’ll briefly cover what this indicator describes and how to interpret it. First, we need to know a little bit about moving averages also. Moving averages are lagging indicators that use a specific number of previous values to calculate a current value.

Moving Averages

In stock trading, a common moving average is the Simple Moving Average (SMA). This takes the last n-many closing prices (n being the number of previous days specified) and calculates the average price of all those.

For example, if a particular security’s five previous closing prices were {10, 15, 20, 25, 18} the SMA for the current day would be 10+15+20+25+18 = $17.6. Adjusting the number of previous days can be useful in adjusting a moving average for different purposes.

Convergence & Divergence

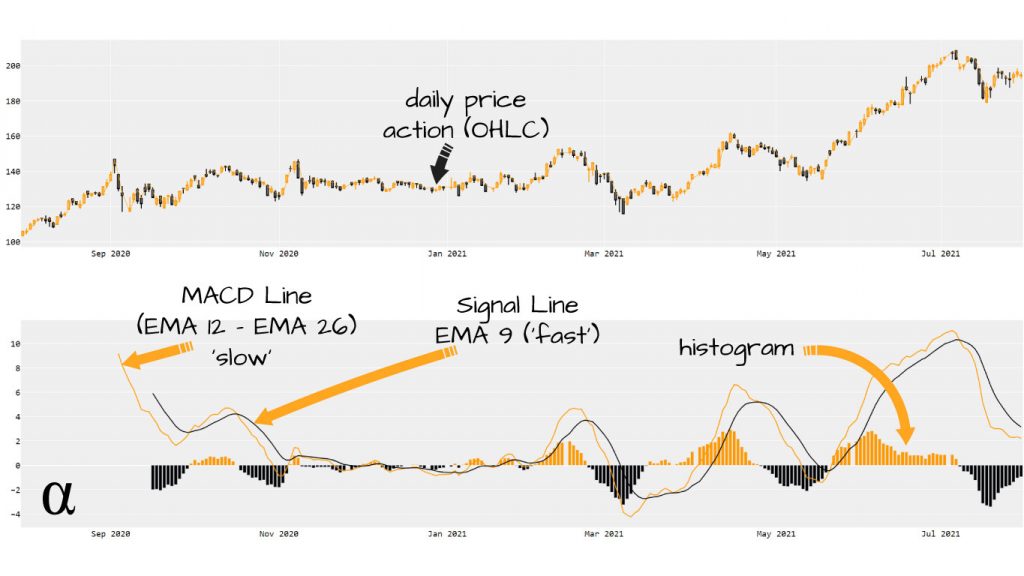

The MACD represents 3 district values, each of which are interconnected. The insights provided by the MACD require one to understand how each of these values is calculated, what they represent, and the implications of movement relative to one another. Below are the MACD’s main primary signals.

MACD – the value of an exponential moving average (EMA) subtracted from another EMA with a shorter lookback period. Common values are 26 days for the longer EMA and 12 for the shorter. This is referred to as the ‘slow’ signal line of the MACD.

Signal– the EMA of the MACD of a period shorter than the shortest period used in calculating the MACD. Typically, a 9-day period is used. This is referred to as the ‘fast’ signal line.

Difference – The difference between the MACD – Trigger line is used to represent current selling pressures in the marketplace. This value is commonly charted as a histogram overlaying the MACD + Trigger signals. A positive value for this signal represents a bullish trend whereas a negative value indicates a bearish one.

Check out our detailed article Moving Average Convergence Divergence (MACD) for a more technical and in-depth discussion on how this indicator is calculated and interpreted.

Calculating the MACD in Python

With a refreshed understanding of MACD, we can now consider how to calculate it within a Python environment. The MACD can be manually calculated in Python using nothing but built-in functions and custom function definitions as with all technical indicators. For our discussion here, we’ll be looking at two more abstracted approaches:

- Calculating the MACD using built-in functions native to Pandas DataFrame objects;

- Using the

pandas_talibrary to more conveniently calculate the MACD across aDataFrame.

Before we can calculate the MACD, visualize the MACD, or even apply the MACD to our trading strategy we’ll need to take one paramount action—get some data! For this, we’ll use the yfinance library to conveniently pull in some historic pricing data for $BTC-USD as follows:

import yfinance as yf

# Request historic pricing data via finance.yahoo.com API

df = yf.Ticker('BTC-USD').history(period='1y')[['Close', 'Open', 'High', 'Volume']]

# View our data

print(df)

Close Open High Volume

Date

2020-08-02 11053.614258 11758.764648 12034.144531 27410067336

2020-08-03 11246.348633 11043.768555 11453.079102 20271713443

2020-08-04 11205.892578 11246.203125 11385.381836 21250197042

2020-08-05 11747.022461 11203.823242 11786.617188 24411254471

2020-08-06 11779.773438 11749.871094 11902.335938 23400740340

... ... ... ... ...

2021-07-29 40008.421875 39995.453125 40593.070312 27167146027

2021-07-30 42235.546875 40027.484375 42235.546875 33072782960

2021-07-31 41626.195312 42196.304688 42231.449219 25802845343

2021-08-01 39974.894531 41460.843750 42541.679688 26688438115

2021-08-02 39716.246094 39943.519531 40414.351562 27748661248

[363 rows x 4 columns]

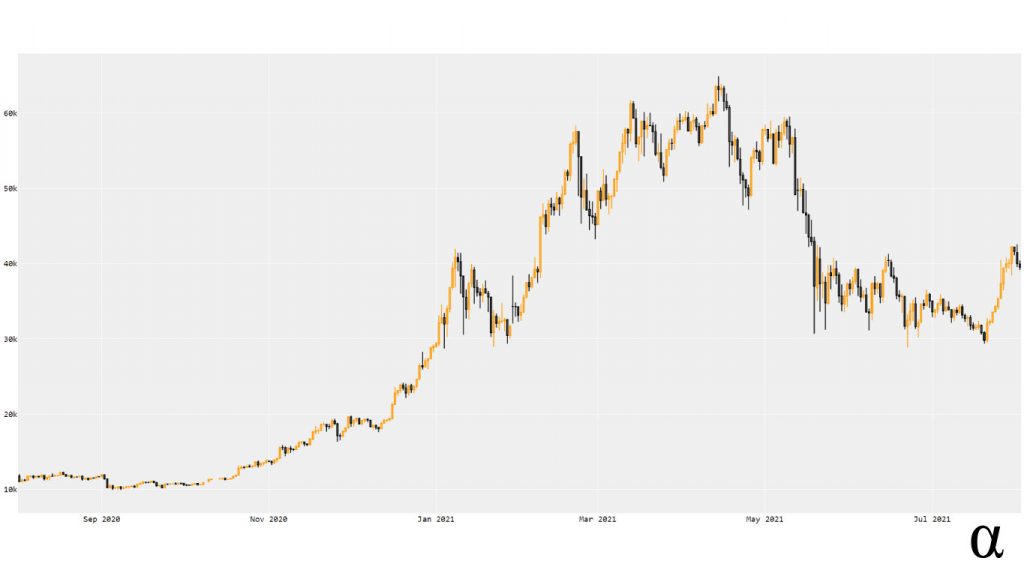

This results in 363 rows of data across which our MACD will be applied. This will give us a fairly large view of how the MACD operates and how it may have—or may not have—helped explain some of the price action as $BTC-USD moved from $11,053 to $39,716 in a year (a 259% increase!) Here’s a Candlestick chart (created in Plotly) representing our data:

Method 1: Calculating the MACD with Pandas

Pandas provides a built-in function to its DataFrame class named ewm() which stands for exponentially-weighted mean. This will allow us to calculate the MACD and the Trigger values that will, in turn, provide us with the raw values needed to represent the convergence/divergence. Consider the following code:

import yfinance as yf

# Request historic pricing data via finance.yahoo.com API

df = yf.Ticker('BTC-USD').history(period='1y')[['Close', 'Open', 'High', 'Volume', 'Low']]

# # Calculate MACD values using the pandas_ta library

# df.ta.macd(close='close', fast=12, slow=26, signal=9, append=True)

# Get the 26-day EMA of the closing price

k = df['Close'].ewm(span=12, adjust=False, min_periods=12).mean()

# Get the 12-day EMA of the closing price

d = df['Close'].ewm(span=26, adjust=False, min_periods=26).mean()

# Subtract the 26-day EMA from the 12-Day EMA to get the MACD

macd = k - d

# Get the 9-Day EMA of the MACD for the Trigger line

macd_s = macd.ewm(span=9, adjust=False, min_periods=9).mean()

# Calculate the difference between the MACD - Trigger for the Convergence/Divergence value

macd_h = macd - macd_s

# Add all of our new values for the MACD to the dataframe

df['macd'] = df.index.map(macd)

df['macd_h'] = df.index.map(macd_h)

df['macd_s'] = df.index.map(macd_s)

# View our data

pd.set_option("display.max_columns", None)

print(df)

Close Open High Volume \

Date

2020-08-02 11053.614258 11758.764648 12034.144531 27410067336

2020-08-03 11246.348633 11043.768555 11453.079102 20271713443

2020-08-04 11205.892578 11246.203125 11385.381836 21250197042

2020-08-05 11747.022461 11203.823242 11786.617188 24411254471

2020-08-06 11779.773438 11749.871094 11902.335938 23400740340

... ... ... ... ...

2021-07-29 40008.421875 39995.453125 40593.070312 27167146027

2021-07-30 42235.546875 40027.484375 42235.546875 33072782960

2021-07-31 41626.195312 42196.304688 42231.449219 25802845343

2021-08-01 39974.894531 41460.843750 42541.679688 26688438115

2021-08-02 39199.132812 39943.519531 40414.351562 27577835520

Low macd macd_h macd_s

Date

2020-08-02 11018.129883 NaN NaN NaN

2020-08-03 11012.415039 NaN NaN NaN

2020-08-04 11094.145508 NaN NaN NaN

2020-08-05 11158.285156 NaN NaN NaN

2020-08-06 11598.713867 NaN NaN NaN

... ... ... ... ...

2021-07-29 39352.058594 1198.565947 1071.163927 127.402019

2021-07-30 38397.355469 1599.001238 1177.279375 421.721863

2021-07-31 41110.832031 1845.901114 1139.343401 706.557713

2021-08-01 39540.941406 1886.577580 944.015893 942.561686

2021-08-02 38783.878906 1835.063020 714.001067 1121.061953

[363 rows x 8 columns]

Here we see our MACD values added to the DataFrame object as columns. These values can be used to inform algorithmic signals or serve as the basis for visualization. Note the first values for our MACD calculations are NaN values.

These result from our use of the min_periods argument when applying the Pandas ewn function. This instructs Pandas to not calculate values until there are as many as our window available (avoids using 0 values in calculations.) Without this specification, we would generate a LOT of false signals early on.

We could 100% start charting this data out for a visualization right now. However, we’re going to look at one more approach for calculating the MACD in Python. This approach, using the pandas_ta library, is much more succinct.

Method 2: Calculating the MACD with pandas_ta

Python’s rise to fame as one of the most popular programming languages can be largely attributed to its vast ecosystem of third-party libraries. Pandas, as we’ve already seen, offers a powerful framework for manipulating tabulated data.

The pandas_ta library is built on top of the Pandas library and integrates an immense number of technical indicator functions. These functions integrate natively with the DataFrame class and are applying via standard dot-notation access. Let’s see how using the pandas_ta library can calculate our MACD values in many fewer lines of code:

import pandas_ta as ta

# Request historic pricing data via finance.yahoo.com API

df = yf.Ticker('BTC-USD').history(period='1y')[['Close', 'Open', 'High', 'Volume', 'Low']]

# Calculate MACD values using the pandas_ta library

df.ta.macd(close='close', fast=12, slow=26, signal=9, append=True)

# View result

pd.set_option("display.max_columns", None) # show all columns

print(df)

close open high volume \

date

2020-08-02 11053.614258 11758.764648 12034.144531 27410067336

2020-08-03 11246.348633 11043.768555 11453.079102 20271713443

2020-08-04 11205.892578 11246.203125 11385.381836 21250197042

2020-08-05 11747.022461 11203.823242 11786.617188 24411254471

2020-08-06 11779.773438 11749.871094 11902.335938 23400740340

... ... ... ... ...

2021-07-29 40008.421875 39995.453125 40593.070312 27167146027

2021-07-30 42235.546875 40027.484375 42235.546875 33072782960

2021-07-31 41626.195312 42196.304688 42231.449219 25802845343

2021-08-01 39974.894531 41460.843750 42541.679688 26688438115

2021-08-02 39178.742188 39943.519531 40414.351562 27401984000

low MACD_12_26_9 MACDh_12_26_9 MACDs_12_26_9

date

2020-08-02 11018.129883 NaN NaN NaN

2020-08-03 11012.415039 NaN NaN NaN

2020-08-04 11094.145508 NaN NaN NaN

2020-08-05 11158.285156 NaN NaN NaN

2020-08-06 11598.713867 NaN NaN NaN

... ... ... ... ...

2021-07-29 39352.058594 1198.565947 1071.163927 127.402019

2021-07-30 38397.355469 1599.001238 1177.279375 421.721863

2021-07-31 41110.832031 1845.901114 1139.343401 706.557713

2021-08-01 39540.941406 1886.577580 944.015893 942.561686

2021-08-02 39165.199219 1833.436418 712.699785 1120.736633

[363 rows x 8 columns]

Here we see our MACD values (labeled a bit differently) having been calculated in a single line of code. This illustrates both the power and convenience of the pandas_ta library! Note that the values in the last few rows of our data differ slightly from our Pandas-native calculations. This results from how Pandas applies calculations and is beyond the scope of this article. See this informative thread on Stackoverflow for more insight. For now, let’s take our data and start visualizing!

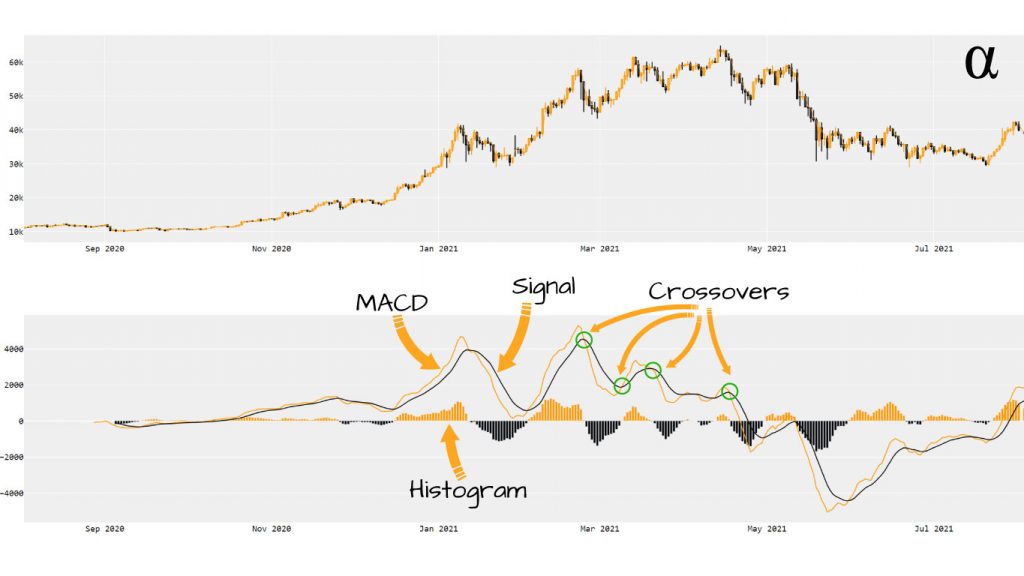

Visualizing the MACD in Python with Plotly

The MACD values we have so far are 100% enough to inform an algorithmic trading strategy. However, being able to visualize technical indicators when developing trading algorithms is indispensable. In the following section we’ll cover how to use the Plotly visualization library to accomplish the following feats:

- Chart the price as a Candlestick visualization similar to the chart seen above;

- Chart the MACD and Signal lines in a second chart, below the Candlestick;

- Chart the Convergence/Divergence series as a Histogram overlaying our signal lines.

Plotly makes all of these tasks straightforward, though there are some tweaks we’ll make that aren’t explicitly outlined in the documentation. Don’t worry—it’s nothing too complicated. Consider the following code:

# get ticker data

df = yf.Ticker('BTC-USD').history(period='1y')[map(str.title, ['open', 'close', 'low', 'high', 'volume'])]

# calculate MACD values

df.ta.macd(close='close', fast=12, slow=26, append=True)

# Force lowercase (optional)

df.columns = [x.lower() for x in df.columns]

# Construct a 2 x 1 Plotly figure

fig = make_subplots(rows=2, cols=1)

# price Line

fig.append_trace(

go.Scatter(

x=df.index,

y=df['open'],

line=dict(color='#ff9900', width=1),

name='open',

# showlegend=False,

legendgroup='1',

), row=1, col=1

)

# Candlestick chart for pricing

fig.append_trace(

go.Candlestick(

x=df.index,

open=df['open'],

high=df['high'],

low=df['low'],

close=df['close'],

increasing_line_color='#ff9900',

decreasing_line_color='black',

showlegend=False

), row=1, col=1

)

# Fast Signal (%k)

fig.append_trace(

go.Scatter(

x=df.index,

y=df['macd_12_26_9'],

line=dict(color='#ff9900', width=2),

name='macd',

# showlegend=False,

legendgroup='2',

), row=2, col=1

)

# Slow signal (%d)

fig.append_trace(

go.Scatter(

x=df.index,

y=df['macds_12_26_9'],

line=dict(color='#000000', width=2),

# showlegend=False,

legendgroup='2',

name='signal'

), row=2, col=1

)

# Colorize the histogram values

colors = np.where(df['macdh_12_26_9'] < 0, '#000', '#ff9900')

# Plot the histogram

fig.append_trace(

go.Bar(

x=df.index,

y=df['macdh_12_26_9'],

name='histogram',

marker_color=colors,

), row=2, col=1

)

# Make it pretty

layout = go.Layout(

plot_bgcolor='#efefef',

# Font Families

font_family='Monospace',

font_color='#000000',

font_size=20,

xaxis=dict(

rangeslider=dict(

visible=False

)

)

)

# Update options and show plot

fig.update_layout(layout)

fig.show()

This may look like a lot of code but the excess is mostly boilerplate. When using the Plotly fig.show() function our figure will be launched as a chart in the system default HTML viewer (probably Chrome.) This provides an interactive display where each period’s values can be inspected via mouse-over functions, scale can be adjusted, and several other useful actions including exporting as a .jpg or .png.

In the above illustration, we can see our price charted in the top figure and our relevant MACD data plotted on the bottom figure. I find having the price data visualized along with the MACD helps provide a more complete means of assessing the market.

On the bottom figure, we can see our MACD line in yellow, our Signal line in black, and several notable crossover points circled in green. The histogram, displayed a bar chart under the MACD and Signal lines, reflects yellow when the difference between the MACD and Signal is positive (uptrend) and black when the value is negative (downtrend.)

Common Gotchas

When visualizing MACD data there are some common issues that may arise. Firstly, there may be gaps in the data on non-trading days—depending on where the data is sourced from and how the DataFrame is indexed. There are [at least] two approaches for dealing with this, each with pros and cons:

Interpolating missing values to create a smooth transition. Note that the unit of frequency needs to be provided to Pandas for this calculation. If you’re using weekly data, hourly, or something other than Daily the 'D' needs to be replaced:

df.asfreq('D').interpolate()

Removing non-trading days by setting bounds on the Plotly visualization. This can also set time-period bounds as well to remove after-hours trading on trading data with a resolution lower than single-day bars:

fig.update_xaxes(

rangebreaks=[

dict(bounds=['sat', 'mon'])

]

)

Each of these approaches has its pros and cons but I tend to find the second to win out. The inclusion of estimated values in the data might work find for broad trend analysis but could cause some false signals here.

Review

The MACD’s popularity among technical traders can be attributed to its ease of interpretation and long-standing success rates. As with any technical indicator, the MACD is best used alongside other indicators to maximize the probability of generating a valid trade signal.

Combining the MACD with other signals such as the Simple Moving Average (SMA) to help identify resistance and support levels is one popular combo. Another long-standing approach is to use the MACD and the Relative Strength Index (RSI) in tandem to reinforce the signals generated by either.

Whichever indicator combinations your strategy may entail one thing is clear—if the MACD is involved it can easily be integrated via Python. The approaches shown here to visualize the MACD using Plotly are fairly basic but still provide valuable visualizations to help inform trading decisions.

For those seeking more complex applications, check out the article on Predicting Stock Prices with Linear Regression in Python. The MACD could easily be integrated into such modeling—or even more complex machine learning models.