Investment advisors are individuals, groups, or legal entities that provide individualized recommendations for capital allocation. The formal definition of Investment Advisor (IA) was first defined by the Investment Advisers Act of 1940 (IAC) and outlines registration requirements and exemptions for those providing financial advice.

Investment advisors may be referred to as financial advisors or stockbrokers and sometimes reflect the “adviser” spelling such as it was referred to in the IAC. Information and advice qualifying an entity as an Investment Advisor may include direct one-on-one advice or more indirect means such as the sharing of reports, analyses, or written communications such as blogs, newsletters, or emails.

Highlights

Based on qualifying activities, some individuals working as Investment Advisors may be exempt from registration via regulations at their respective State, Federal, or both levels. This article outlines the following concerns with respect to investment advisors:

- Activities that may be considered investment advising.

- The types of entities that may qualify as investment advisors.

- Examples of investment advisors.

- Federal vs. State regulations of investment advisors.

- Registration requirements, exemptions, and exceptions.

- Notable legislation governing investment advising in the United States.

The obligatory starting place is to first consider what type of people and entities’ business activities can be considered for qualifying them as providing investment advice.

Introduction: Legal Definition of ‘Person’

Legislative language regarding Investment Advisors discusses qualifications with respect to specific Persons1. This term is not used as it is in common language and covers a broader range of people and entities including the following:

- Natural person

- Corporations

- Partnerships

- Associations

- Join-Stock companies

- Trusts

- Unincorporated Organizations

- Governments

- Specific political subdivisions of Governments

In the context of financial advisors, the definition of a Person can, perhaps, be more easily understood as those entities that are not considered Persons:

- minors

- deceased individuals

- natural persons declared by a court as “mentally incompetent”

The definition of a Person is used in a regulatory context to determine if the recipient of financial advice qualifies the provider as a legislated Advisor.

Investment Advising: What Qualifies & Who Needs to Register

With the above understanding of the types of entities (herein referred to as Persons) that may have their activities considered by securities regulators, one can begin qualifying these activities to assess the need for IA registration. A “three-prong” test is often used for casual consideration:

- Giving advice to others on securities;

- Giving advice as part of regular business;

- Receives compensation for giving advice on securities;

These three points for consideration follow formal definition within the IAC in section 202(a)11 as such3:

‘‘Investment adviser’’ means any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities, or who, for compensation and as part of a regular business, issues or promulgates analyses or reports concerning securities;

These three considerations lay the groundwork for assessing whether the activities of a Person necessitate their registration as an investment adviser. Advice being given can be face-to-face (i.e. oral advice) or via email, print, or online media (i.e. remote advice).

It’s important to note that securities do not include commodities, collectibles, metals, or real estate. It’s also important to note that any of these investment vehicles could be part of a financial device that is a security — such as an ETF fund for silver.

Common activities that fall under the purview of Investment Advice include financial planners, pension consultants, stockbrokers, and even sports agents in some cases. It all depends on the nature of the advice and whether the purchase of securities is the primary focus. Such advice might be the entirety, or just a partial aspect of, a larger financial discussion.

There are some notable exceptions and exemptions to these cases that warrant discussion. Before considering exemptions and exceptions for IAs however, it is important to understand the difference between an investment advisor and an investment counsel.

Investment Advisors vs. Investment Counsel

Some investment advisors are further qualified as “counsel” based on certain actions that apply to their regular activity. The first qualifying characteristic for an investment advisor to be considered an investment counsel is that the main aspect of that entity’s business is related to providing investment advice.

For example, an attorney who informally recommends a client invest a large settlement in a mutual fund is not providing financial advice as part of their primary service. However, if that same attorney offered to help the same client handle the settlement for a separate fee, they would fall under the purview of investment advising.

Having met the condition of their primary business being investment advice, an advisor may be further qualified as an investment counsel in the following cases:

- They hold discretionary authority over capital accounts

- They do not hold the discretionary authority of capital accounts, but if their recommendations for specific securities are accepted they execute purchasing.

There are some cases that border on qualifying as investment counsel. However, due to several interpretations throughout the Unified Securities Act, the following cases are not qualifying for investment counsel:

- Making Buy/Sell recommendations for specific securities but NOT executing orders.

- Only providing impersonal advice such as through newsletters, periodicals, or online blogs.

- Making only an initial Buy/Sell recommendation and execution but without providing subsequent management and monitoring of that security.

- Only providing advice on a non-periodic basis such as per client request or in response to a specific market event.

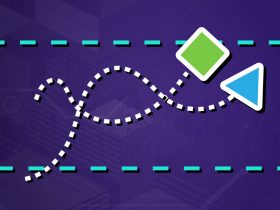

Keep in mind that in both cases, such that financial advice is either qualified as counsel or not, it is still qualified as financial advice. As such, actions qualifying as financial advising are a superset of actions qualifying as financial counsel or also that providing financial counsel is a subset of providing financial advice.

Investment Advisor Regulation

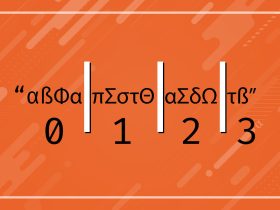

The Investment Advisers Act (IAA) of 1940 regulates investment advising at the federal level. The Uniform Securities Act (USA) of 1956 regulates investment advisors at the State level. The USA is considered “model legislation” such that each U.S. State and territory adopts a local version adjusted for State-level concerns.

Such State-level legislation of investment advisors is handled by the Administrator with the most capital of A’s possible. The State IA Administrator controls the approval, denials, and revocation of any IA licensing within their respective jurisdiction. At the federal level, the Securities Exchange Commission (SEC) oversees the registration process.

Registration Thresholds

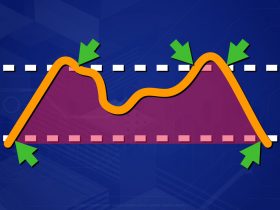

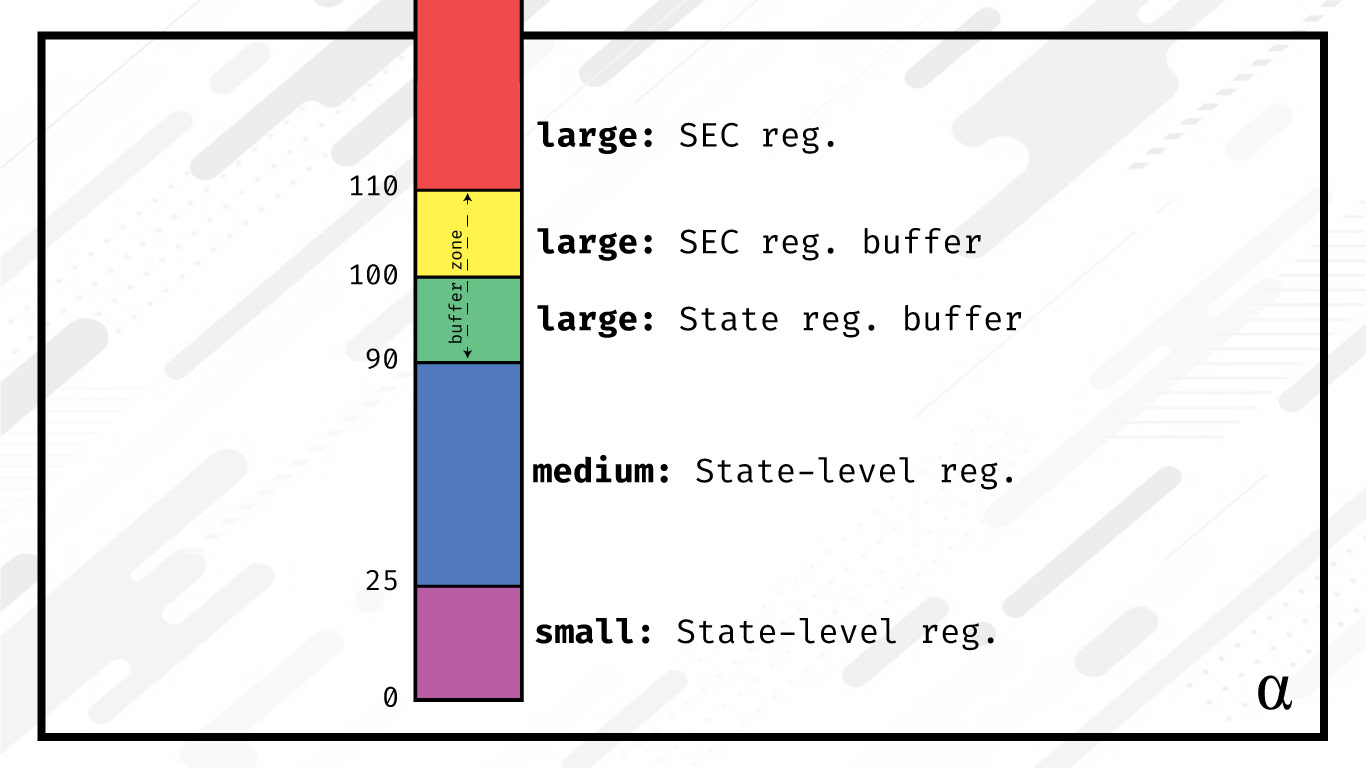

Investment advisors are required to register at the State level in the United States unless certain qualifying characteristics are met. If the aggregate of and IA’s Assets Under Management (AUM) exceeds $110mm registration with the SEC is mandatory. IA’s become eligible with an AUM of $100mm or more per the annual reporting. However, certain exemptions are granted such that certain investment advising activities do not require registration.

There is a slight buffer in place such that, should an IA’s AUM drop below the $100mm eligibility threshold, they would not be required to withdraw SEC registration until AUM fell below $90mm. This is much like the $10mm buffer in the opposite direction: qualifying an IA as eligible for SEC registration at $100mm but not becoming mandatory until $110mm. All totaled, there is a $20mm buffer zone. This can be visualized as follows:

These thresholds were established in the National Securities Markets Improvement Act of 1996 (NSMIA). Prior to the NSMIA, investment advisors registered with both State and Federal agencies. The NSMIA established these thresholds, in addition to the dynamics of the buffer zone, to simplify the system on a national scale4.

AUM qualifying for SEC or State-level registrations are considered per-annum. This allows periodic threshold breeches without requiring a change in registration authority. For example, an SEC-registered IA’s AUM may fall below the $90m buffer intra-year due to market fluctuations. If at the time of reporting, the IA’s AUM were to once again be above $90mm, they would not be required to withdraw their SEC registration status.

Grace Periods

The NSMIA establishes a 120-day window in which Medium-scale IAs must withdraw their State-level registrations and register with the SEC. For IAs dropping below the $90mm threshold after having registered with the SEC, thus mandating State-level registration, they are provided a 180-day period of time. The extra 60 days is provided since the IA may be required to register with multiple State agencies based on their business activity.

In all cases, unless otherwise exempt, a ‘Person’ conducting activities considered investment advising is required to register as an Investment Advisor at either the State or Federal level. Since NSMIA, no IA is ever to be registered at both levels simultaneously.

Threshold Exceptions

There are several noteworthy exceptions to the NSMIA thresholds established above. In the following cases, an IA that would otherwise not be eligible for federal coverage may register with the SEC under the following conditions:

- Required to register in 15 or more States

- Expecting more than $100mm in AUM within the first 120 days of business

- Internet-only business activity

In these cases, an IA may proceed to register with the SEC directly and skip State-level registration entirely4.

Exemptions & Exclusions

Within Federal and State legislation there are a number of cases where a Person’s actions (not exclusively a natural person) do not require them to register in their respective State as a financial advisor. These cases fall into one of two (similar) categories:

- Exemptions: Actions are considered financial advice but the Person is not required to register regardless.

- Exclusions: Actions are not considered as providing financial advice.

It is important to note that a Person may be regularly engaged in, even as part of their primary business operations, providing financial advice without being required to register. These cases are explicitly outlined in the Unified Securities Act and Administered similarly at the State level. They include the following cases1:

- Bank-Holding companies: Directing the execution of financial actions in a way that percent voting occurs;

- Lawyers, Accountants, Teachers, or Engineers (L.A.T.E.): may provide incidental advice during the execution of their primary business actions.

- Broker-Dealer: A Person executing Buy/Sell orders of securities but not providing recommendations for specific actions.

- Publishers: Purveyors of generalized advice that is both non-promotional and regularly circulated vs. distributed only in response to certain market events.

- Employees of Investment Advisors: Those taking actions on behalf of registered IAs are, in some certain cases, not required to register.

- Federal Advisors – IAs covered under Federal registration guidelines and deemed compliant in that sense. This also includes an IA whose direct obligations are recommendations for the U.S. Federal Government.

- Administrator Exempted: Those that engage in qualifying activity but, for whatever purpose, have been issued an individual exemption by the State Administrator.

Federal vs. State Exemptions

For the most part, federal exemptions outlined in the Investment Advisors Act and State exemptions outlined in the Unified Securities Act align seamlessly. In other words, what the IAA exempts is mostly what the USA exempts. There are some notable cases where these bodies of legislation differ, however.

Federal Exemptions (IAA-covered)

- Single-State advisors: Those located only in a single State, advising clients in a single State, and only advising on securities not traded on national exchanges are exempt from federal registration.

- Insurance Company advisors: Those advisors whose only clients are insurance companies are not required to register at the Federal level. It is worth noting that Banks are not considered insurance agencies in this regard.

State Exemptions

The prerequisite for all State-level exemptions is that an Investment Advisor is registered in at least 1 other State such that the registration exemptions are for a potential new market of business and have no local place of business (PoB). Assuming an IA is registered in another State, additional State-level exemptions may be applied for the following cases:

- IA is a Broker-Dealer only

- Advising other advisors

- Institutional advising

- Advising existing, non-residents in the State on a temporary basis only (e.g. vacation)

- Having no more than 5 clients and having been a resident for the previous 12 months

- Given specific Exemption by the State Administrator

The place of business can be defined as publicly-advertised, non-owned venues such as golf courses, hotels, or conference centers. However, if these locations are used only to meet specific clients, they are non-qualifying as places of business. For example, meeting 5 clients regularly via an advertised service at a local hotel isn’t exempt but meeting clients at the same hotel when they are in town would be.

Foreign Exemptions

Non-U.S. investment advisors may be exempt from registration in certain cases also. Qualifying characteristics include:

- No U.S. registered place of business.

- Fewer than 15 U.S.-based clients.

- Less than $25mm in aggregate AUM among all U.S. clients.

- Not advising an Investment Company as defined by the ICA.

Dodd-Frank Exemptions

In addition to guidelines in the IAA and USA acts, the Dodd-Frank act of 2010 also outlines certain exemptions on a State and Federal level for Investment Advisor registration requirements. Particularly, Title IV a.k.a the Private Fund Investment Advisors Registration Act outlines the following exemptions:

- Investment advisors to private funds with less than $150mm AUM.

- Non-U.S.-based investment advisors, with no place of business in the U.S., and no greater than $25mm AUM among all U.S. clients.

- Investment advisors whose sole clientele are Venture Capital funds.

These exemptions are restricted only to those providing investment advice to qualifying private funds. The Dodd-Frank Act, in section 402, provides the following clarity as to what qualifies an investment fund as private2:

The term ‘private fund’ means an issuer that would be an investment company, as defined in section 3 of the Investment Company Act of 1940 but for section 3(c)(1) or 3(c)(7) of that act.

The text of the Investment Company Act (ICA) of 1940 can clarify further by providing a reference for the definitions and exceptions mentioned in the Dodd-Frank Act. Section 3 of the ICA defines an “investment company” as the following3:

Any issuer [of securities] which is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting, or trading of securities, is engaged or proposes to engage in the business of issuing face-amount certificates of the installment type, or has engaged in such business and has any such certificate outstanding, or is engaged or proposes to be engaged in the business of investing, reinvesting, owning, holding or trading in securities, and owns or proposes to acquire investment securities having a value exceeding 40 per centum of the value of such issuer’s total assets (exclusive of Government securities and cash items) on an unconsolidated basis.

This is a wordy description but there are three key aspects being described:

- Investing, reinvesting, or trading securities

- Issuing face-amount certificates (FACs) of the installment type (e.g. real property)

- Buying more than 40% of an issuer’s total assets (i.e. 40% of a company)

An investment advisor is further exempted from registration requirements under Dodd-Frank if the Investment Fund meets either of the following two criteria outlined in the ICA:

- 3(c)1: Any issuer whose outstanding securities are beneficially owned by not more than one hundred persons and do not currently, nor have plans to, make a public offering of its securities.

- 3(c)7: All owners of the funds securities are qualified investors among other misc qualifying characteristics.

Section 3(c)7 is an important part of the Act outside of the Investor advisor exemption implications. This clause often directs the type of investors that new, non-SEC registered and reporting, entities are able to consider. Should an investor not be a “qualified investor” a.k.a. acreddited investor the entity would have to start reporting to the SEC. As such, these guidelines steer many startups towards organizing in such a way that retail investors are given access. Reader-friendly information on accredited investors is available on the SEC website.

Venture Capital Exemptions

In cases of Venture Capital funds advisors are exempt from registration provided the fund operates and represents itself in the following characteristic ways:

- Investors are only offered liquidation/redemption rights under certain circumstances.

- Is represented as a Venture Capital firm to investors.

- Is not registered in accordance with the ICA.

Takeaways

Investment advisors can provide integral financial guidance to a range of investment vehicles ranging from single natural persons to full-fledged, multi-national corporations. They help manage pension funds, scholarship funds, venture capital funds, and even government grant programs. These operators play vital roles within broader financial systems and can help translate complicated legal gears into actionable concepts for those seeking financial benefit.

The role of an investment advisor, integral as it is, understandably comes with much legal guidance. Cornerstone legislation such as the Dodd-Frank Act, the Uniform Securities Act, and the Investment Company Act all make provisions for the role investment advisors play in the larger economic environment.

This article has discussed many possible exemptions both at the State and Federal levels for investment advisors in the United States. Understanding exemptions is as much about empowering investment advisors to know when they do need to be registered as to when they do not.

References

- North American Security Administrators Association. “Uniform Securities Act (1956), as Amended.”

- United States (2010). “Dodd-Frank Wall Street Reform and Consumer Protection Act: Conference report (to accompany H.R. 4173).” Washington: U.S. G.P.O.

- United States. (1940). “Investment Company Act of 1940,” Pages 17-21.

- United States (2006). “National Securities Markets Improvement Act of 1996.”